Types of Mutual Funds

TYPES OF MUTUAL FUNDS

BNI ASSET MANAGEMENT PRODUCTS

Up to now, PT BNI Asset Management has managed Mutual Funds with a complete product range as follows:

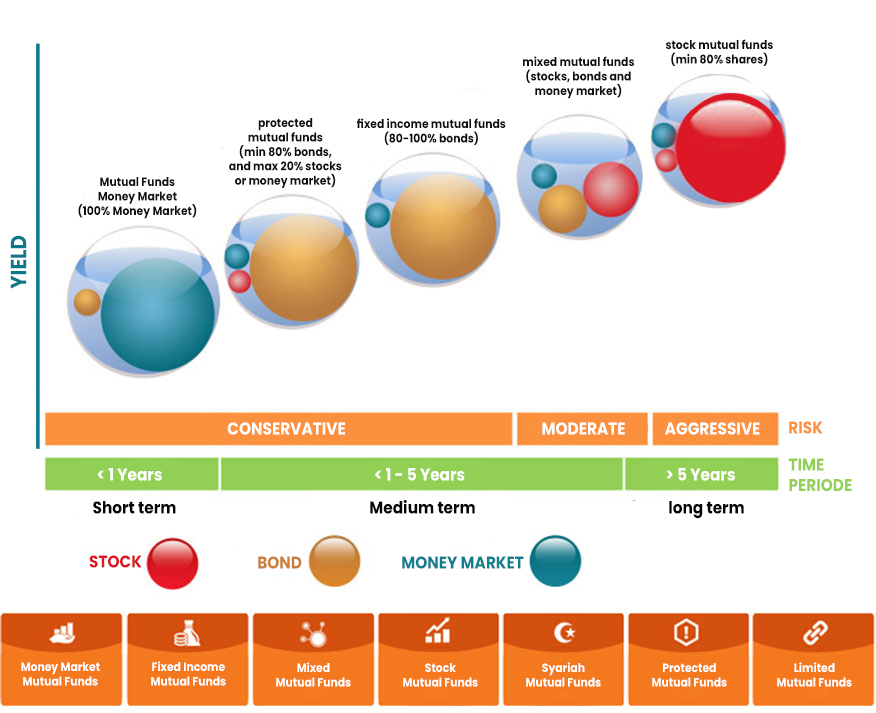

Money Market Mutual Funds

It is a Mutual Fund that only invests in domestic money market instruments and/or debt which is issued with a period of not more than 1 (one) year, and/or the remaining maturity is not more than 1 (one) year. Money Market Mutual Funds are Mutual Funds that have the lowest risk but also provide a limited return.

Fix Income Mutual Funds

Namely Mutual Funds that invest at least 80% (eighty percent) of the Net Asset Value in the form of Debt Instruments. Investment risk is higher than Money Market Mutual Funds but lower than Mixed or Equity Funds.

Mixed Mutual Fund

Mutual Funds that invest in equity securities, debt securities, and/or domestic money market instruments, each of which is a maximum of 79% (seventy nine percent) of the Net Asset Value, where in the Mutual Fund portfolio there must be securities equity and debt securities. Investment Risk is higher than Money Market Mutual Funds, Fixed Income Mutual Funds but lower than Equity Mutual Funds.

Equity Funds

Spesifically Mutual Funds that invest at least 80% (eighty percent) and Net Asset Value in the form of Equity Securities. Investment risk is higher among other Mutual Funds.

Protected Mutual Funds

Protected Mutual Funds have a special characteristic, namely the existence of a protection mechanism (except a guarantee from the Investment Manager or other third parties) against the principal value of the initial investment, if there is no default from the instrument or debt issuer. Securities used or the parties involved in the investment portfolio of this product. Mutual Funds are generally categorized as low to medium risk investments and are generally used for medium and long term investment purposes.

Aside from being plain vanilla (100% of the underlying portfolio is a protection basis), this type of Mutual Fund can also be in the form of a Protected Mutual Fund with a minimum composition of 70% protection base and an Enhancer component (maximum 30% of the portfolio) which can be in the form of equity, debt securities, and derivative instruments both at domestic and abroad.

Limited Mutual Funds

Reksa Dana Terproteksi, memiliki fitur khusus adanya mekanisme proteksi (namun bukan jaminan dari pihak Manajer Investasi maupun pihak ketiga lainnya) terhadap nilai pokok investasi awal, jika tidak terjadi wanprestasi dari instrumen atau emiten penerbit surat hutang yang digunakan atau pihak yang terlibat dalam portofolio investasi produk ini. Reksa Dana Terproteksi umumnya dikategorikan sebagai investasi risiko rendah hingga menegah dan umumnya digunakan untuk tujuan investasi jangka menengah dan panjang. Selain yang bersifat plain vanilla (100% dari portofolio underlying merupakan basis proteksi), Reksa Dana jenis ini juga dapat berupa Reksa Dana Terproteksi dengan komposisi minimum 70% basis proteksi dan komponen Enhancer (maksimum 30% dari portofolio) yang dapat berupa ekuitas, surat utang dan derivative instruments baik dalam maupun luar negeri.

Limited Mutual Funds

It is an Mutual Fund in the Form of a Limited Participation Collective Investment Contract, which needs to be refined to suit the objectives of an Mutual Fund in the Form of a Limited Participation Collective Investment Contract in supporting the development of the real sector.

*POJK Nomor 47/POJK.04/2015 concerning Guidelines for Daily Announcement of Net Asset Value of Open Mutual Funds.

English

English

Bahasa

Bahasa